Challenges

- Staff at a Swiss finance company had to manually synchronize information to complete a credit appraisal form. The process was time-consuming and laborious.

- The company’s data structure was decentralized.

- The goal was reduce the workload for the credit appraisal team.

Xpertnest’s Solutions

- Xpertnest developed a Web-based solution to reduce the time needed to calculate credit appraisals and reply to customers.

- The credit appraisal tool provided immediate lead verification, assessed the client’s financial stability, and determined whether they met the minimum credit criteria.

- Created a platform for customers to see their eligibility for credit, and the maximum credit available.

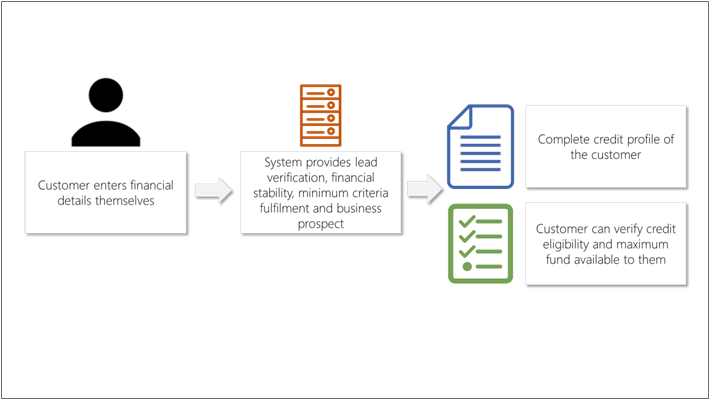

omer enters financial details

The system provides lead verification, financial stability, minimum criteria fulfilment, and business prospects

Customer receives complete credit profile

Customer reviews credit eligibility and funding available.

Value Delivered

- Improved client service for sales teams, enhancing follow-up and documentation.

- Produced error-free financial appraisals. The system used the financial information available to calculate the entire financial ratio, compare it with the company standard, and provide a complete credit profile.

- Because customers can verify their own credit, unwanted credit proposals were filtered automatically by customers.

- Reduced the work load of the credit appraisal team, improving credit appraisal, and reducing financial risk.